how to calculate nj taxable wages

If you make 199000 a year living in the region of New Jersey USA you will be taxed 58251. Access IRS Tax Forms.

Division Of Temporary Disability And Family Leave Insurance Family Leave Insurance

The actual amount of tax taken from an employees paycheck is also dependent on their filing status single or married and number of allowances both of which are reported.

. Both employers and employees contribute. New Jersey allows employers to credit up to 737 in earned tips against an employees wages per hour which can result in a cash wage as low as 263 per hour. We dont make judgments or prescribe specific policies.

In short youll have to file your taxes in both states if you live in NJ and work in NY. Unemployment Insurance UI. Free 2-Day Shipping wAmazon Prime.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. New Jersey has a 6625 statewide sales tax rate. This 5000000 Salary Example for New Jersey is based on a single filer with an annual salary of 5000000 filing their 2022 tax return in New Jersey in 2022.

Calculate your New Jersey net pay or take home. Ad Easy To Run Payroll Get Set Up Running in Minutes. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Free 2-Day Shipping wAmazon Prime. Start filing your tax return now. Calculating your New Jersey state income tax is similar to the steps we listed on our Federal paycheck.

In New Jersey unemployment taxes are a team effort. Balance of Unemployment Trust Fund is the balance in the Fund as of March 31st of the current year. The New Jersey Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and New Jersey.

Rates range from 05 to 58 on the first. Detailed New Jersey state income tax rates and brackets are available on this page. 1256-8 1256-13 and 1256-14.

The withholding tax rates for 2022 reflect graduated rates from 15 to 118. See what makes us different. The 118 tax rate applies to individuals with taxable.

New Jersey Income Tax Calculator 2021. Like most US States both New York and New Jersey require that you pay State income taxes. New Jersey Income Tax Calculator 2021.

To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. 2022 Taxable Wage Base UI and WFSWF - workers and employers TDI employers. 39800 2022 Taxable Wage Base TDI FLI workers only.

Complete Edit or Print Tax Forms Instantly. You must report all payments whether in. How to Calculate Withhold and Pay New Jersey Income Tax Withholding Rate Tables Instructions for the Employers Reports Forms NJ-927 and.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The states SUTA wage base is 7000 per. Check the box - Advanced NJS Income Tax.

Your average tax rate is 1198 and your marginal tax. Your average tax rate is 2035 and your marginal tax. Taxes Paid Filed - 100 Guarantee.

Ad Read Customer Reviews Find Best Sellers. Just enter the wages tax withholdings and other information required. You can alter the salary example.

Ad Read Customer Reviews Find Best Sellers. Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. New Jersey Gross Income Tax.

Taxes Paid Filed - 100 Guarantee. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. Under the FLSA these.

If you make 70000 a year living in the region of New Jersey USA you will be taxed 12783. O You can exclude from New. After a few seconds you will be provided with a full breakdown.

Wages include salaries tips fees commissions bonuses and any other payments you receive for services you perform as an employee. Rates for board and room meals and lodging under the New Jersey Wage and Hour laws or regulations may be found at NJAC. Taxable Retirement Income.

All New Jersey employees contribute to the cost of Temporary Disability and Family Leave Insurance through a salary deduction that you are responsible for listing on their. Payroll So Easy You Can Set It Up Run It Yourself. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

151900 In accordance with NJAC.

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Debt Management Debt Help Credit Debt

Stamped Letter Income Verification

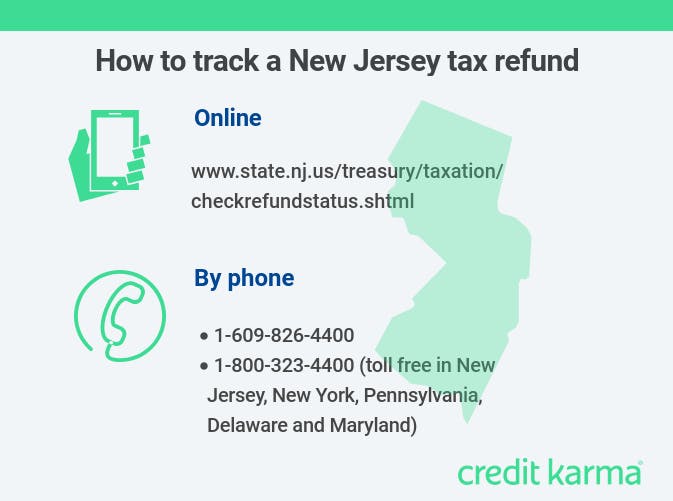

How To Track A Nj Tax Refund Credit Karma

1099 R Software To Create Print And E File Irs Form 1099 R

Highest Property Taxes In America Property Tax Real Estate Trends New York County

Looking For A City Income Tax Return For Individuals Download It For Free

The Salary You Need To Afford The Average Home In Your U S State Vivid Maps Map Usa Map 30 Year Mortgage

Services Provided By New Jersey Payroll Services Llc Templates Sample Resume Resume Template Free

How Green Is Your State Vivid Maps

Cypress Texas Property Taxes What You Need To Know

Five States Ca Nj Ri Ny Hi Offer Paidleave For Temporary Disability Learn More In A New Report Family Medical Medical Leave Medical

Pay Stub Templates 10 Free Printable Word Excel Pdf Science Words Templates Words

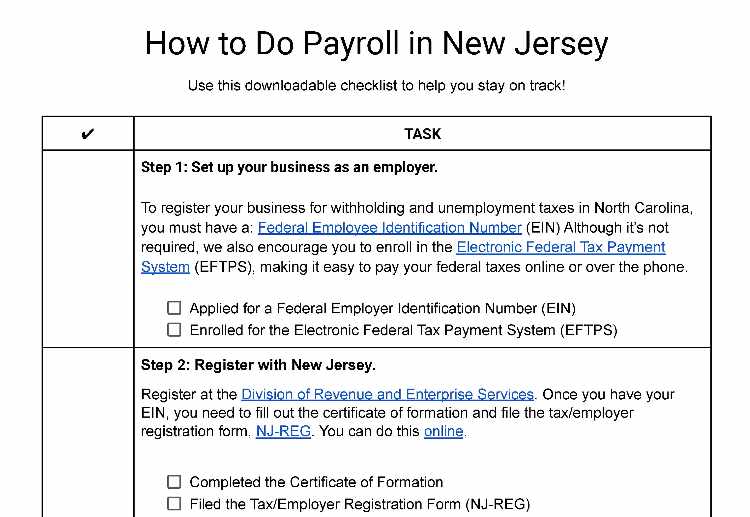

How To Do Payroll In New Jersey Everything Business Owners Need To Know